Billing Automation Platform

You automate billing. Your clients manage it themselves. One platform, €20/mo.

Billing Automation

- Automated invoicing

- Payment recovery & dunning

- Bank reconciliation

- Subscription management

You set it up. It runs on autopilot.

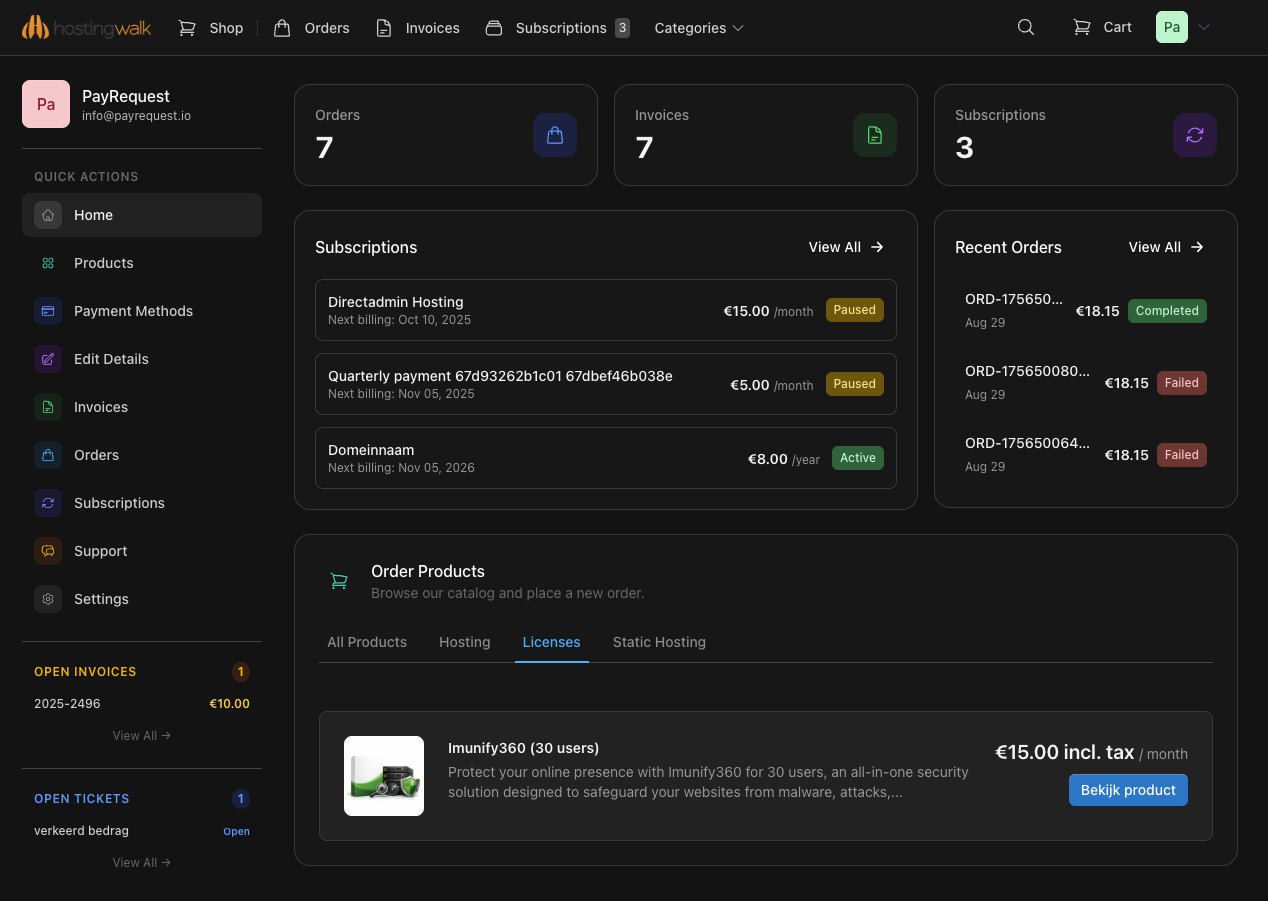

Client Billing Portal

- View & pay invoices

- Manage subscriptions

- Download receipts

- Update payment methods

They manage it themselves. Zero emails to you.

Connect Stripe, Mollie, or bank transfers. All features included.

“Our clients used to email us every month for invoices and plan changes. Now they handle everything in the portal. Support tickets dropped by 70%.”

“We were using Stripe’s customer portal but clients kept emailing us for everything it couldn’t do. PayRequest filled every gap.”

“Managing deposits and recurring invoices for 80+ clients was a nightmare. PayRequest automated everything. We finally have time to focus on growing the business.”

Every month, your team loses a full workday to billing tasks your clients could handle themselves.

These emails land in your inbox every week. Each one costs 5–10 minutes. Multiply that by 50 clients.

“Can you resend my invoice?”

Clients can’t access their own billing history. Every month, the same request lands in your inbox.

“I want to upgrade my plan”

Subscription changes become email threads. You make the change manually, then confirm, then follow up.

“What’s my deposit status?”

No system tracks deposits. You check a spreadsheet, then write back. Rinse and repeat every month.

“My payment didn’t go through”

You find out after the revenue is already lost. No automatic retry. No recovery sequence. Just a missed payment.

“We paid by bank transfer”

Bank transfers aren’t auto-matched to invoices. You reconcile them manually, line by line, every month.

“Where do I download the files?”

Clients can’t access deliverables, contracts, or documents from their billing account. You email attachments manually.

You automate billing. Your clients manage it themselves.

Set up invoicing, subscriptions, and payment recovery once — then give every client a self-service portal to handle the rest.

- View & pay invoices

- Manage subscriptions

- Update payment methods

- Pay or track deposits

- Download files & deliverables

- View contracts

- Request refunds

- Submit support requests

Your clients handle billing themselves — fewer tickets, faster payments, happier customers.

- Recurring invoices & schedules

- Subscription management

- Customer profiles & segmentation

- Security deposit automation

- Bank matching & reconciliation

- Dunning & payment recovery

- Tag-based organization

- EU VAT compliance

Connect Stripe, PayPal, or Mollie

Sign up & connect

Create your account and connect Stripe, PayPal, or Mollie for payments.

Set up billing

Add customers, create invoices, subscriptions, or deposit schedules.

Activate portal

Each client gets a branded self-service portal with everything they need.

Automate the rest

Recovery, reconciliation, and reporting run on autopilot.

Connect Your Payment Provider. We Handle the Rest.

PayRequest handles billing, portal, and automation. Your payment provider handles the actual payment processing.

Your Payment Provider

Stripe, PayPal, or Mollie

PayRequest

Portal + Automation

Your Clients

Self-service portal

See Your Recurring Revenue in Real Time

A financial command center for your entire client billing operation. Know exactly where your revenue stands at any moment.

Designed for businesses that bill clients monthly

Agencies

Automate retainer billing, manage project-based invoicing, and give each client their own portal.

- Monthly retainer billing

- Project milestone invoices

- White-label client portal

- Contract management

Hosting Providers

Subscription plans, automated dunning, domain management, and integrated support — all in one system.

- Recurring subscription plans

- Automated dunning & recovery

- Support request management

- Domain & service tracking

Rental Businesses

Security deposits, recurring rental payments, seasonal adjustments, and tenant self-service access.

- Security deposit collection

- Recurring rental payments

- Seasonal pause & resume

- Tenant portal access

IT Service Providers

Managed service contracts, license billing, SLA-based pricing, and automated support ticket integration.

- Per-seat license billing

- SLA-tiered pricing

- Automated contract renewals

- Client support portal

Consultants

Retainer agreements, hourly billing, project deposits, and professional client-facing invoices.

- Retainer & hourly billing

- Project deposit handling

- Client self-service portal

- Professional invoicing

Installation & Maintenance

Service contracts, maintenance schedules, deposit management, and recurring billing for ongoing work.

- Service contract billing

- Maintenance schedule invoicing

- Security deposit management

- Client self-service access

Not all customer portals are created equal

Here’s what you get when you add PayRequest to your payment provider.

Great at processing payments. But the customer portal is limited — no deposits, no file delivery, no support system, no reconciliation.

Everything your provider does, plus the complete portal layer — deposits, files, contracts, support, recovery, reconciliation, and custom branding.

Your clients deserve a better billing portal.

Start billing in minutes. Connect Stripe, PayPal, or Mollie for payments.